The XRP market is witnessing a surge in interest and speculation due to several significant developments worldwide.

With Coinbase introducing regulated futures and increasing demand in South Korea, Ripple’s native token is creating a buzz despite some stagnation in short-term performance. Analysts and traders are keeping a close eye, as both regulatory changes and institutional movements could reshape the future price of XRP in the months ahead.

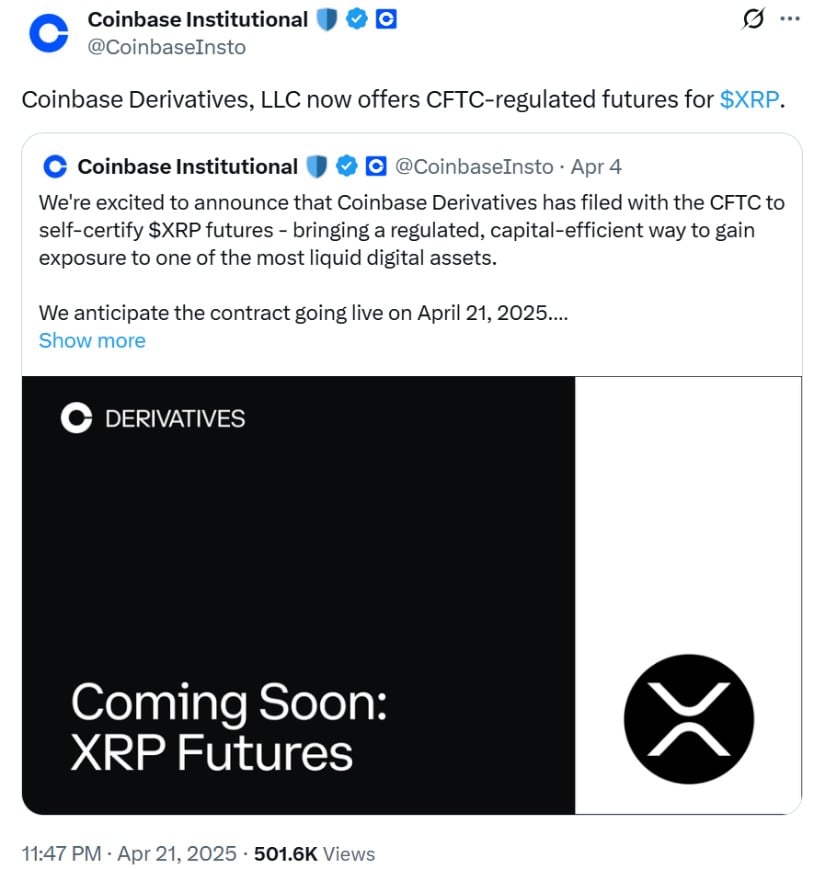

COINBASE LAUNCHES REGULATED XRP FUTURES

Coinbase has officially launched CFTC-regulated XRP futures, an important milestone in fostering institutional adoption. These approved futures contracts enable regulated exposure to the Ripple-linked asset, further legitimizing XRP within the financial landscape.

Coinbase Derivatives LLC has debuted CFTC-regulated futures for XRP. Source: Coinbase Institutional via X

“This initiative transcends a mere product launch; it offers institutions a secure, compliant path to engaging with XRP,” remarked a market strategist. Compared to previous offerings from Bitnomial, Coinbase’s introduction of futures indicates rising demand from traditional finance participants who are seeking regulatory clarity.

Regulated crypto futures often signify potential developments like spot exchange-traded funds (ETFs). A recent Kaiko report indicates XRP has surpassed Solana in the U.S. spot ETF race, attributed to enhanced market liquidity. Currently, more than a dozen XRP ETF applications await review, which could trigger another significant price surge.

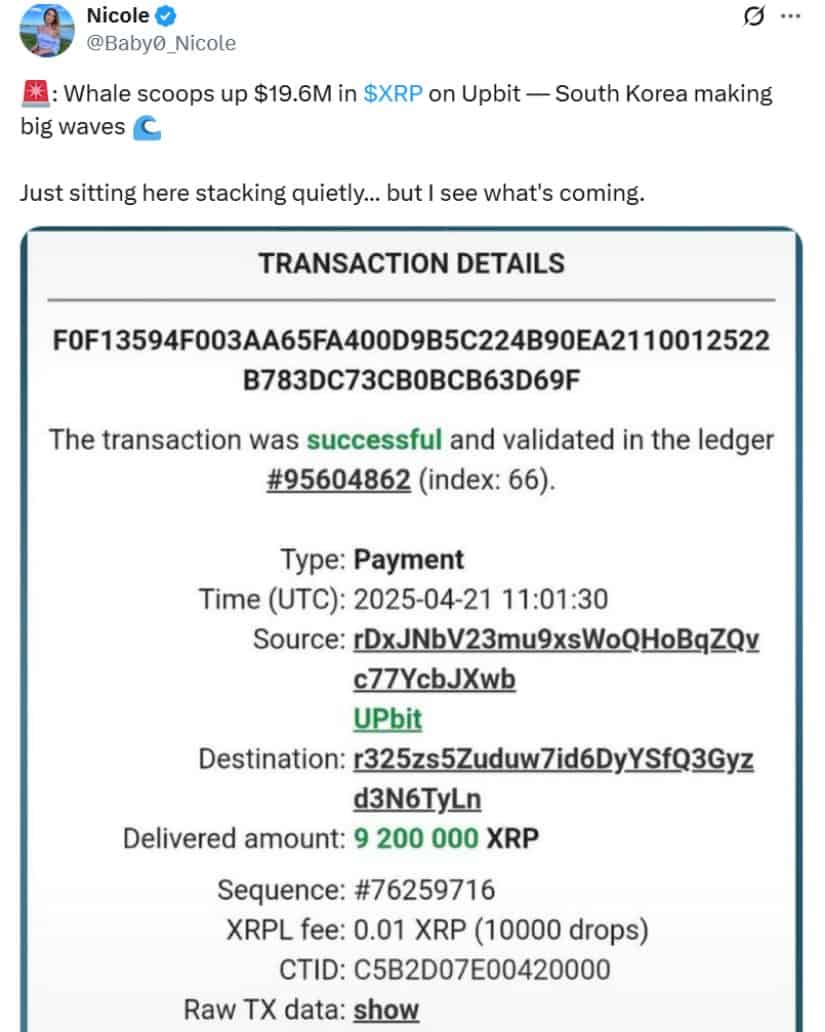

XRP LEADS SOUTH KOREAN TRADING MARKETS

In South Korea, XRP has established itself as a significant player, consistently outperforming Bitcoin in terms of trading volume. On Upbit—South Korea’s premier exchange—XRP’s daily trading has recently exceeded $6 billion, representing over a third of the total trading volume.

A notable investor recently purchased $19.6 million in XRP on Upbit, showcasing South Korea’s increasing significance in the XRP market.

More than 3.5 million individuals in South Korea reportedly own XRP, constituting a large portion of the population. Analysts attribute this local interest to the token’s utility in cross-border transactions and its attractiveness as a stable alternative amid ongoing geopolitical tensions.

“There is evidently strong confidence in XRP’s practical application,” stated an analyst from Seoul. “Unlike speculative cryptocurrencies, XRP addresses real issues in international finance—something that resonates well with Korean investors.”

This strong demand emerges as XRP nears critical price thresholds. With the token fluctuating around $2.15, just under the resistance level at $2.20, technical analysts suggest that buying momentum could propel it toward $2.29 if trends continue, sparking discussions about XRP’s future price potential.

NEW SEC LEADERSHIP SPARKS HOPE FOR RIPPLE LEGAL CASE

In a development that adds to the positive momentum, Paul Atkins has been appointed as the new SEC Chair, succeeding Gary Gensler. Atkins, a known advocate for digital innovation, is anticipated to guide the agency toward more crypto-friendly policies. His arrival has reignited discussions regarding a possible resolution in the long-standing lawsuit involving XRP.

Paul Atkins now serves as SEC Chair, potentially indicating a shift toward favorable regulations for cryptocurrencies.

Sources suggest that the SEC might be more inclined to withdraw its appeal in the ongoing dispute about XRP’s classification as a security. Such a decision would not only close a lengthy legal battle but could also pave the way for an XRP spot ETF, a transformative event for the Ripple ecosystem.

“Having an ETF for your cryptocurrency is like being part of a band and getting your songs streamed everywhere,” remarked Bloomberg’s Senior ETF Analyst Eric Balchunas. “While it doesn’t guarantee success, it places your asset in front of most investors.”

Ripple’s CEO, Brad Garlinghouse, has previously expressed the company’s readiness to grow post-litigation, referencing recent acquisitions and partnerships, including the substantial purchase of Hidden Road, valued at $1.3 billion.

CAUTION ADVISED AMID INSTITUTIONAL ACTIVITY

Despite these encouraging developments, XRP’s price continues to face challenges. Currently trading around $2.09, the asset has found difficulty overcoming resistance, even with positive news emerging. Some analysts speculate that this situation may be intentional.

At press time, XRP hovered near $2.10. Source: XRP Liquid Index (XRPLX)

A key voice in the XRP community, known as 589Bull, argues that the lack of price movement is a strategic move designed to shake out retail investors. He believes institutions are covertly developing vital infrastructure—like futures markets, ISIN codes, and ETF frameworks—while suppressing market excitement to accumulate assets at lower prices.

“Price is not the reality; it’s the trap,” he claimed. “XRP is currently being integrated into the future financial system, but retail investors aren’t the focus yet.”

He cautions that pursuing quick gains or panicking over price drops may lead investors to miss out on the long-term vision that is slowly taking shape behind the scenes.

LOOKING AHEAD: A CRUCIAL MOMENT FOR RIPPLE XRP?

With Coinbase futures, South Korea’s trading supremacy, and renewed optimism concerning legal matters, XRP is once again in the limelight. While its present price may not fully encapsulate these advancements, the foundations being established today could drastically influence its future.

As Ripple’s crypto adoption accelerates, particularly among institutional players, and with the Ripple lawsuit potentially nearing resolution, the elements may finally be falling into place for a significant breakthrough, both legally and in terms of market performance.