A prominent commentator in the XRP community has been advocating for a culture of accumulation, pinpointing a level that could potentially pave the way for financial independence.

Edoardo Farina, a consistent supporter of increasing XRP holdings, believes that this cryptocurrency has the potential to yield significant profits for those who are patient and hold on throughout market fluctuations.

XRP DISPLAYS STRENGTH

To provide some context, XRP has faced a downturn in its price movements over the past three months, amidst a bearish trend affecting the overall cryptocurrency market. In February 2025, XRP experienced a staggering decline of 29.34%, marking its most substantial monthly loss in over three years. Although the cryptocurrency has displayed some resilience, losses continue to occur, albeit at a diminished rate.

Year-to-date, XRP has retreated by 1.47%, yet it has fared better than the overarching cryptocurrency sector, which has seen more drastic declines. For instance, during the same timeframe, the total market capitalization of cryptocurrencies plummeted by 17.59%, resulting in a staggering loss of $561 billion. Bitcoin (BTC) has decreased by 9.65%, and Ethereum (ETH) has suffered a significant downturn of 52.6%.

This resilience contributes to growing confidence among XRP advocates, including Farina, who is optimistic that maintaining a portion of the XRP supply could potentially grant financial freedom. In his analyses, Farina has recommended holding a minimum of 10,000 XRP tokens.

THE PATH TO FINANCIAL FREEDOM WITH 10,000 XRP

Farina contends that individuals may struggle to comprehend the extent of financial liberation achievable by simply retaining 10,000 XRP tokens. As of today, acquiring these tokens would necessitate an investment of approximately $20,150 at the current price of $2.15.

Remarkably, these tokens were valued at around $5,000 just six months prior, in November 2024, when XRP was trading at $0.5. Those who chose to accumulate XRP during that period benefited from a significantly lower investment to secure their holdings. Despite the recent price appreciation, analysts like Farina believe another significant rally is imminent.

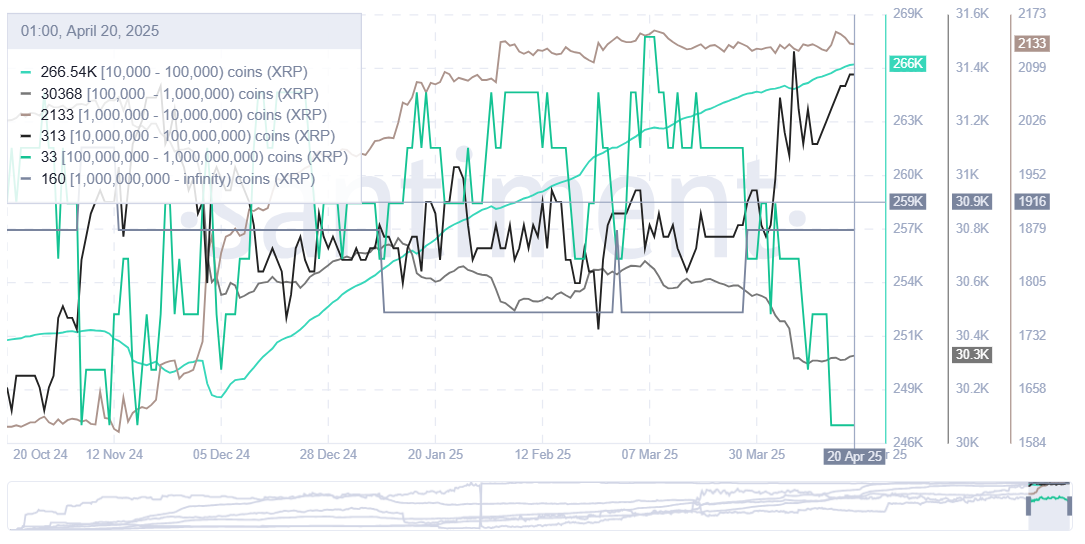

Consequently, they view the current market instability as a rare opportunity to buy on the dip. Data from the behavior analytics platform Santiment illustrates that only 299,547 XRP wallets—accounting for a mere 4.68% of the total 6.398 million addresses—hold at least 10,000 XRP tokens, despite a notable increase in high-value wallets.

Furthermore, additional data indicates that the quantity of wallets possessing at least 10,000 XRP has increased to 287,577 from 287,577 since the beginning of the year. This rise translates to an addition of 11,970 addresses reaching this threshold year-to-date. Despite this upward trend, the figures suggest that investors might still be entering the market early.

UNDERSTANDING FINANCIAL FREEDOM

Farina asserts that those who capitalize on this opportunity now could find themselves on the path to financial independence. However, the definition of financial freedom can differ vastly from person to person. For many, returns of $1 million may signify true financial liberation. Nonetheless, XRP would need to undergo substantial growth to generate such returns from a 10,000-token allocation.

Specifically, for 10,000 XRP to yield a return of $1 million, the price would need to skyrocket to $100. This marks an increase of 4,801% from the current valuation. Several analysts have suggested that this price target is achievable, with Farina asserting last month that XRP should ideally exceed $100 under standard market conditions.

Additionally, in February, Armando Pantoja claimed that XRP is capable of exceeding $100, citing its significant role in international transactions. However, critics such as Rajat Soni argue that this prediction may be overly ambitious, particularly given the current state of the market. Furthermore, wealth mentor Linda Jones does not anticipate the $100 goal being realized within this year.

DISCLAIMER

This article is intended for informational purposes only and should not be construed as financial advice. The opinions expressed herein are solely those of the author and do not necessarily reflect the views of The Crypto Basic. Readers are encouraged to conduct their own research prior to making any investment decisions. The Crypto Basic holds no responsibility for any financial losses incurred.